Everything You Need To Know About Lentor's Property Investment Space

Why Only Some Development There Will Sit on Profit In The Next 5 Years

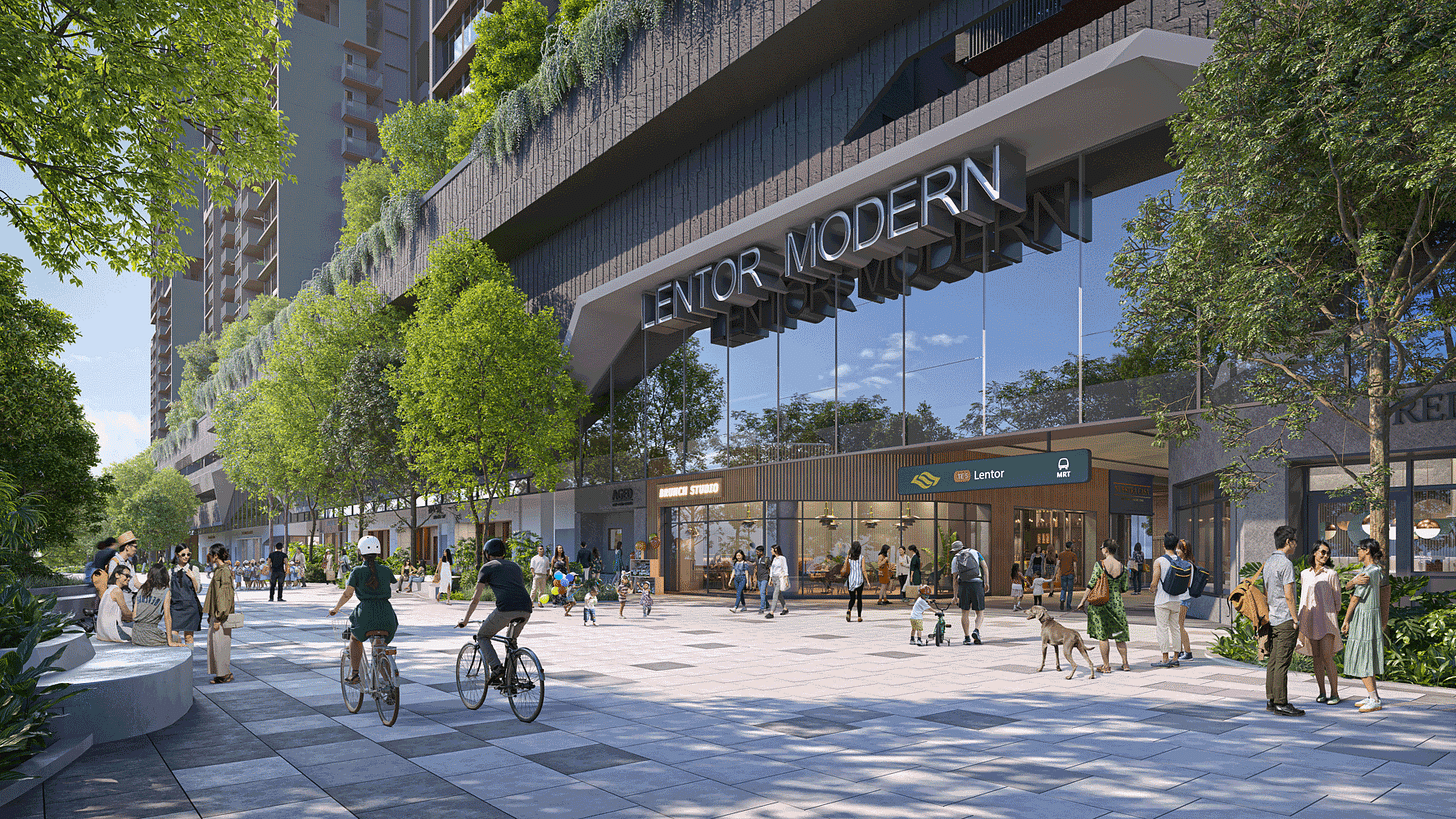

Lentor made waves in 2021 as the first OCR(Outside Central Region) property priced above $2,000 psf. A feat many buyers thought would be something that will happen in the next 5 to 10 years.

As a buyer/investor/reader, you might wonder whether this location is a buy or sell. With concerns looming:

12 potential plots for 5,000 residences making exit strategy a bidding war

Seller’s market at its end and Buyer’s market starting

New plot opening up at Upper Thompson with a huge land space

Whether prices can continue climbing higher

Is rental income good?

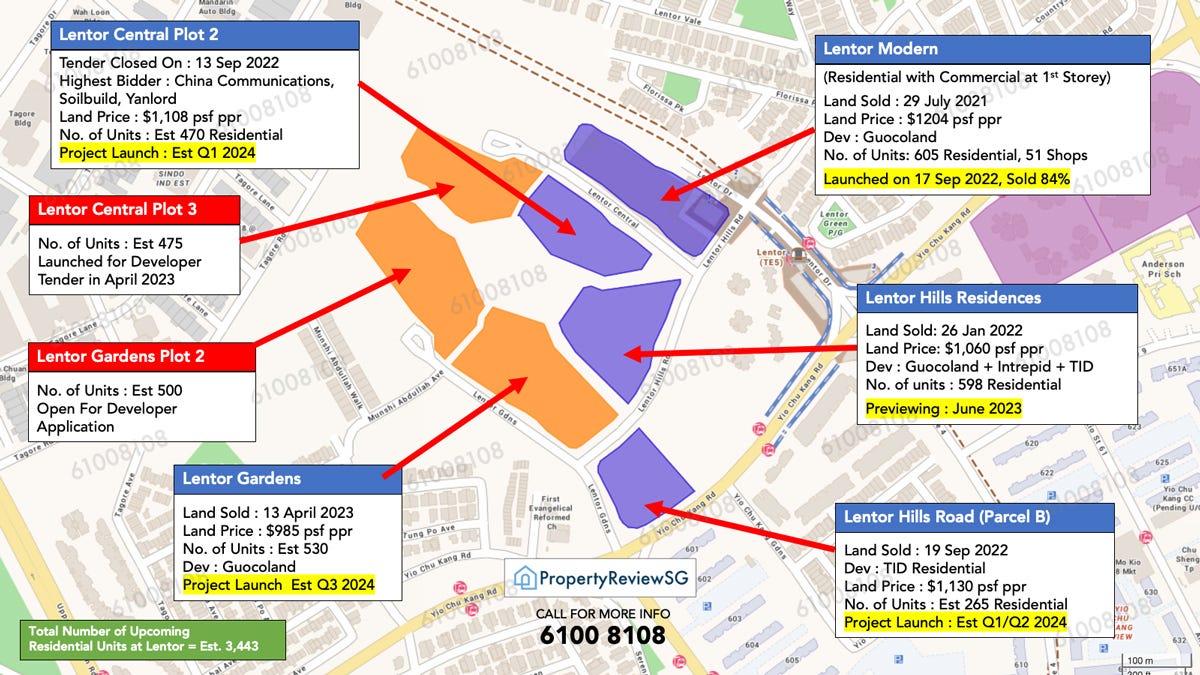

As of right now, only 6 properties have been launched out of the possible 12 plots of land.

While some developments such as Lentor Modern (84% during launch day) and Lentor Masion (75% during launch day) were able to make substantial returns, others such as Lentoria (19% during launch day) failed to attract buyers to their new launches.

Therefore, buyers will need to understand and determine the best strategies for their property investment in Lentor since there are plenty of developments to choose from.

Why Lentor Will Be Able To Hold Its Value

Lentor is to be one of the biggest townships for private property owners in Singapore. Its future returns can be calculated through the developer’s strategic buying of land in the region.

1) Majority Singaporean Buyer

Looking through the property investment record from Edgeprop, we can see that more than 90% of buyer profiles are Singaporean.

High demand from local buyers can lead to stable and sustained property prices. Singaporeans may have a stronger emotional and financial commitment to the local property market, potentially reducing the volatility caused by speculative foreign investments.

If Singaporeans believe that property is a good investment, this positive sentiment can drive demand and price stability.

2) Goucoland Brand

With majority

Guocoland has been a well-known brand in Singapore, the name often carries a sense of luxury and prestige. Iconic residential projects of the Group include Wallich Residence, Martin Modern, Midtown Modern, and Lentor Modern.

Given GuocoLand's reputation and the strategic locations of their projects, properties developed by them often have strong potential for capital appreciation. Investors looking for good returns on their property investments might be particularly attracted to GuocoLand's projects.

3) Tried and Tested

The reason why most small-scale property developer fail in their project is their lack of experience. This is why property developers with a good track record are important.

There’s a saying in property investing: boring is better. And it makes perfect sense because tried and tested properties that have made money over time are less likely to fail.

4) Area Harmonization

Area harmonization refers to aligning and standardizing land use, policies, and regulations across different regions to ensure consistency, efficiency, and compatibility. This research is also backed by Urban Land Institute which found that properties in well-planned, walkable, and mixed-use neighborhoods tend to command higher prices than those in less organized areas.

A great example is Marina Bay, the area is perfectly structured to have an ideal business/residential living for residents/tourists to enjoy.

5) Accessible and Convenient

Hillock Park serves not only as a community park for residents to enjoy, its also as a shortcut towards Lentor MRT.

Apart from public transport, Lentor is sandwiched between Seletar Expressway which goes West to East, and Yio Chu Kang Road which goes South to the CBD (Central Business District).

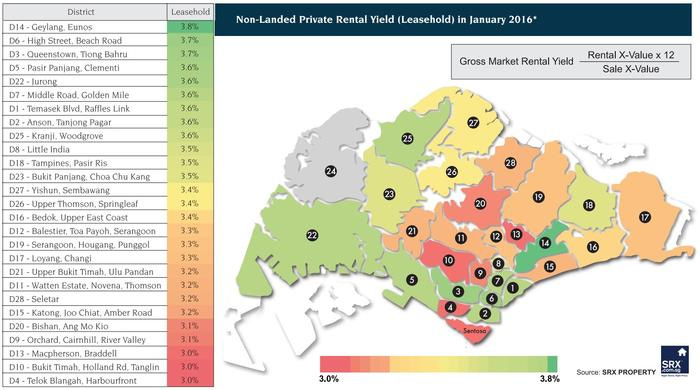

6) Potentially Stable Rental Yield

Lentor is located in District 26, which has stable rental yields in Singapore at 3.4%. While it may not have a high rental yield as compared to other non-landed private property, it makes up its shortfall with potential capital appreciation. With great access as the middle ground of Singapore, it is easy to see why Lentor may be favorable to renters looking for.

7) Defensive Bidding

Defensive bidding is commonly practiced by developers to keep prices around a region stable. Since Upper Thompson's ($905psf) land cost is lower than Lentor's ($985 psf), to keep prices high at $2,000 psf, the developer will need to buy up land from the surrounding region to outcompete competitors from under-bidding these land to be sold at a lower cost.

With the new land bidding available at Upper Thompson fromGuocoland and Heong Long, solidifies them as the main developers in this region.

Which Property Investment Will Do Better

Generally, there are key pointers as to why certain projects in Lentor do better than others.

Near MRT

Is a mixed-use development (Singaporeans love this)

large spacious condo living

lush greenery

The layout is well-utilized

There are many reasons why this is the case but I will go through them if this article do well. So if you enjoy reading this, please like and comment to ask me anything.

PS. If not a licensed real estate agent, I’m merely sharing my opinion and perspective as a real estate analyst.